Things about Clark Wealth Partners

Table of ContentsTop Guidelines Of Clark Wealth Partners7 Simple Techniques For Clark Wealth Partners8 Easy Facts About Clark Wealth Partners DescribedThe smart Trick of Clark Wealth Partners That Nobody is Talking AboutClark Wealth Partners for BeginnersThe Buzz on Clark Wealth PartnersNot known Factual Statements About Clark Wealth Partners How Clark Wealth Partners can Save You Time, Stress, and Money.

Usual factors to think about a monetary expert are: If your monetary scenario has actually become extra complicated, or you do not have confidence in your money-managing skills. Conserving or browsing significant life events like marital relationship, divorce, children, inheritance, or work change that may considerably impact your monetary situation. Navigating the shift from saving for retired life to maintaining wealth during retired life and exactly how to produce a strong retirement earnings plan.New innovation has resulted in more comprehensive automated financial devices, like robo-advisors. It's up to you to examine and establish the right fit - https://pxhere.com/en/photographer-me/4831754. Eventually, an excellent economic advisor should be as conscious of your investments as they are with their very own, staying clear of too much charges, conserving money on taxes, and being as transparent as feasible concerning your gains and losses

The Definitive Guide for Clark Wealth Partners

Gaining a compensation on product referrals does not always mean your fee-based expert works versus your benefits. However they might be much more likely to recommend items and services on which they make a commission, which might or might not remain in your ideal interest. A fiduciary is legally bound to place their customer's rate of interests.

This conventional allows them to make suggestions for investments and services as long as they fit their client's goals, danger resistance, and financial situation. On the various other hand, fiduciary advisors are legitimately obligated to act in their client's finest interest rather than their very own.

Clark Wealth Partners for Beginners

ExperienceTessa reported on all points investing deep-diving into complicated financial topics, shedding light on lesser-known investment opportunities, and revealing methods viewers can work the system to their advantage. As an individual money specialist in her 20s, Tessa is really knowledgeable about the impacts time and unpredictability have on your investment choices.

It was a targeted promotion, and it worked. Learn more Review much less.

The Ultimate Guide To Clark Wealth Partners

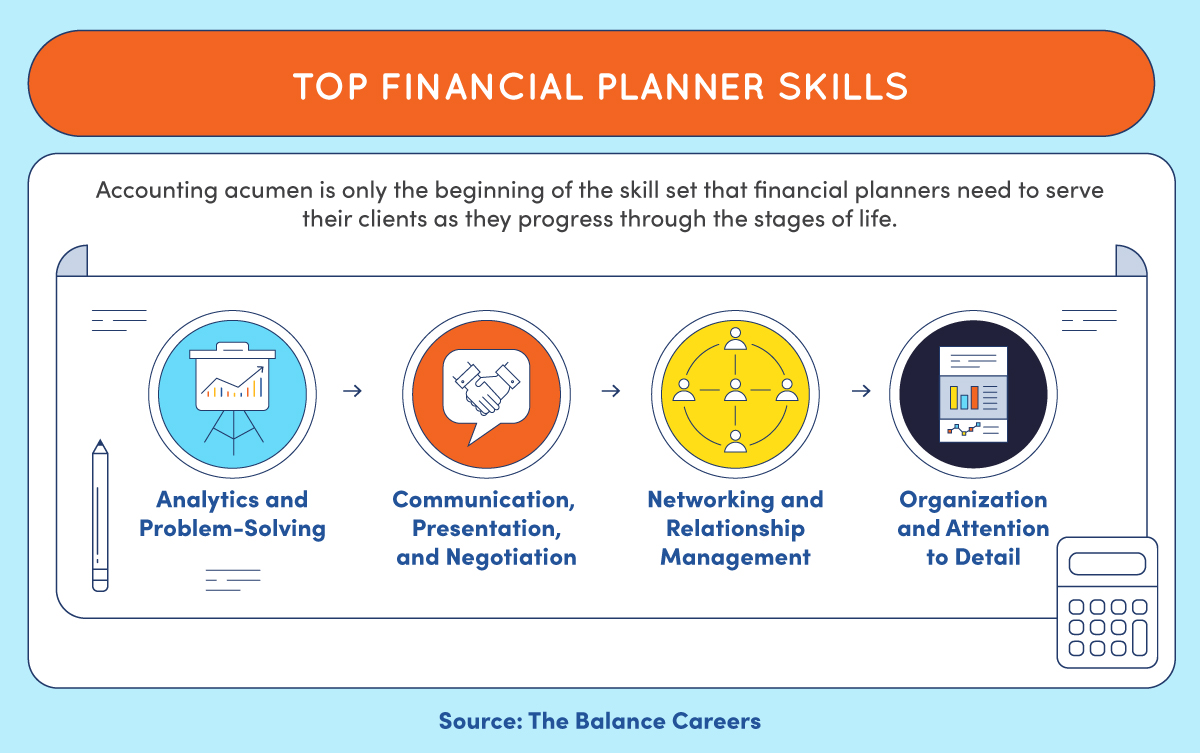

There's no single route to ending up being one, with some individuals beginning in financial or insurance policy, while others start in audit. 1Most economic coordinators begin with a bachelor's degree in financing, business economics, accounting, service, or an associated topic. A four-year degree provides a strong structure for jobs in investments, budgeting, and customer solutions.

Indicators on Clark Wealth Partners You Should Know

Typical instances consist of the FINRA Series 7 and Series 65 examinations for securities, or a state-issued insurance coverage certificate for selling life or medical insurance. While credentials might not be legitimately needed for all planning functions, employers and customers frequently watch them as a standard of professionalism and reliability. We consider optional qualifications in the following section.

Many economic planners have 1-3 years of experience and knowledge with monetary products, conformity standards, and straight customer communication. A solid instructional background Recommended Reading is vital, however experience demonstrates the capacity to apply concept in real-world setups. Some programs integrate both, permitting you to complete coursework while earning monitored hours with internships and practicums.

The smart Trick of Clark Wealth Partners That Nobody is Discussing

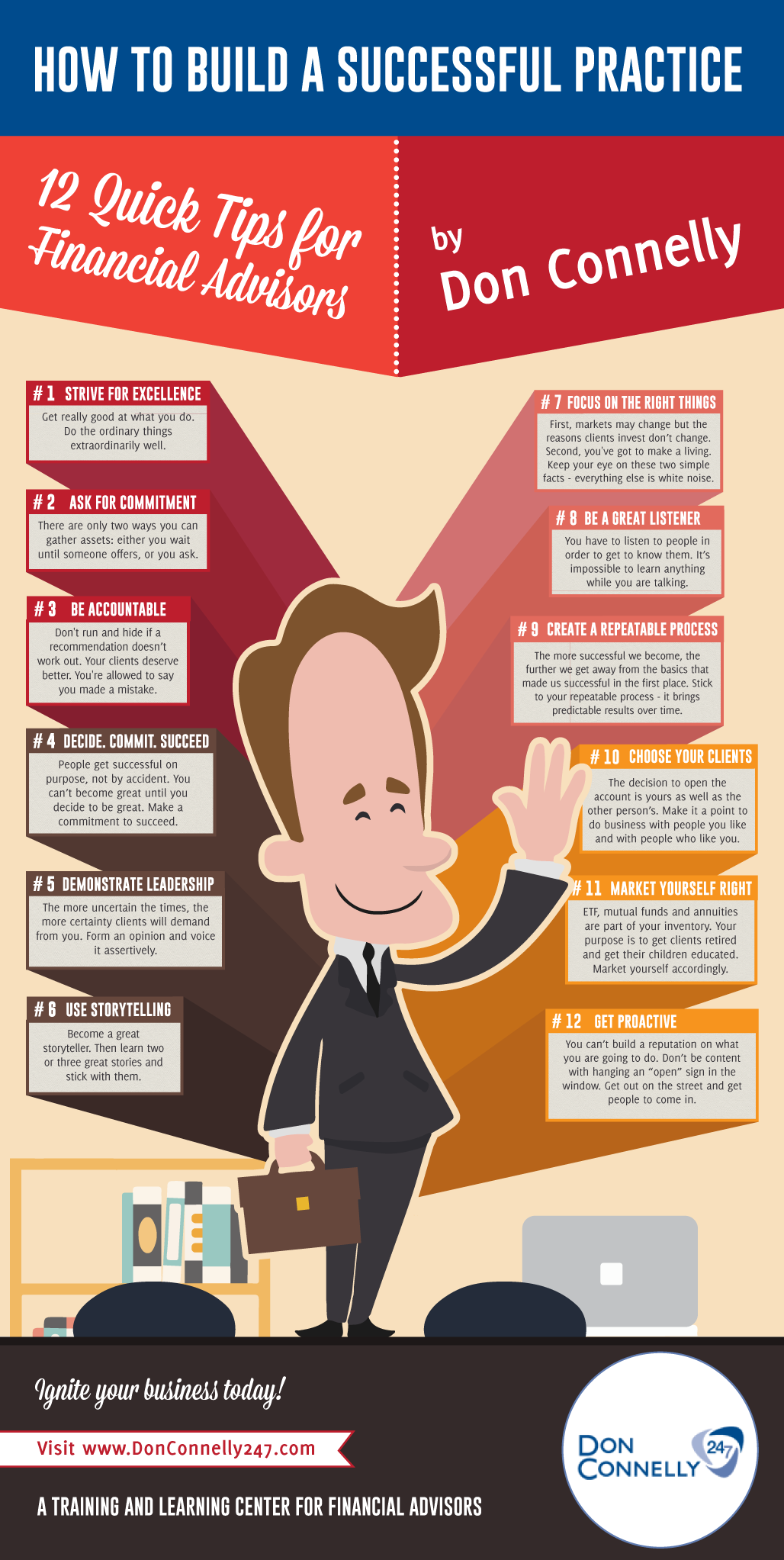

Several get in the area after operating in financial, bookkeeping, or insurance policy, and the change calls for perseverance, networking, and usually advanced credentials. Early years can bring long hours, stress to develop a client base, and the requirement to continually prove your competence. Still, the career supplies solid lasting capacity. Financial organizers take pleasure in the possibility to function very closely with customers, guide important life decisions, and typically achieve versatility in timetables or self-employment.

They invested less time on the client-facing side of the industry. Virtually all monetary supervisors hold a bachelor's level, and numerous have an MBA or similar graduate level.

Getting The Clark Wealth Partners To Work

Optional certifications, such as the CFP, generally need additional coursework and screening, which can prolong the timeline by a pair of years. According to the Bureau of Labor Stats, personal monetary advisors gain a median yearly annual wage of $102,140, with top earners gaining over $239,000.

In other provinces, there are policies that need them to meet certain demands to use the economic consultant or economic coordinator titles. For economic coordinators, there are 3 common classifications: Certified, Individual and Registered Financial Coordinator.

Clark Wealth Partners Fundamentals Explained

Where to find a financial advisor will certainly depend on the type of guidance you need. These establishments have personnel that may assist you comprehend and buy specific types of investments.